Owning a car comes with responsibilities and it’s vital to ensure your car’s taxed but with vehicle excise duty (as car tax is officially called) only available to buy in six, or 12-month blocks, it’s not always practical.

So, if your car’s been written off or you’re selling it, you’ll want to claim back any remaining months – to find out what else you can claim a refund for and how to get one, here’s a handy guide.

Reasons for cancelling car tax

You can only cancel your car tax if your car:

- Has been sold or transferred to a new owner

- Has been taken off the road and you have a SORN (Statutory Off Road Notification)

- Has been written off by your insurer

- Has been taken to a scrapyard

- Has been stolen

- Has been exported out of the country

- Has been registered exempt from car tax (for example if it’s an electric car or vintage).

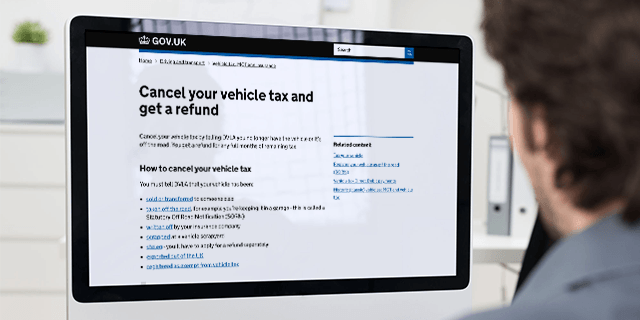

How do I cancel my car tax?

The easiest way to cancel your car tax is to use the DVLA’s online service. The service is currently limited but you can use it to:

- Tell the DVLA that you’ve sold a car or transferred ownership

- Register your car as off the road (SORN)

- Claim back car tax after your insurer has declared it a write-off

If you use the online service, you won’t need to worry about cancelling any Direct Debits as this will be done for you.

If you want to cancel car tax and claim a refund for anything else, head to GOV.UK where you can find instructions on what to do if you want to:

- Claim back car tax because you’ve scrapped your car

- Claim back car tax because your car has been stolen

- Claim back car tax because you’re taking your car outside of the UK

- Report a change to your car tax class (for example if your car is now classed as vintage).

Can I cancel my car tax without my car log book?

If you want to cancel your car tax, you’ll need your log book – officially known as the V5C.

If you’ve lost your log book, you can ask the DVLA for another one but in most cases, there is a fee of £25. Find out more about how to replace your log book and any other lost car documentation here.

Can I get a car tax refund?

You can only claim car tax back for remaining full months but you’ll automatically get a refund if you’re entitled to one. For example, if you’ve paid for 12 months’ worth of car tax but sell your car after three and a half months, you can only get a refund for eight months.

I haven’t received my car tax refund

In can take six weeks for the DVLA to process your claim but if you haven’t received your car tax refund (and are expecting one) or heard anything back after this, you should contact the DVLA directly by:

- Phone – you can call them on 0300 790 6802, they’re open Monday-Friday between 8am and 7pm and also on Saturday between 8am and 2pm, (you’ll be charged up to 10p per minute from a landline or up to 40p from your mobile)

- Post – the DVLA’s postal address is Vehicle Customer Services, DVLA, Swansea, SA99 1AR

- Email – to use the email service, simply select the option you want from the list and follow the instructions.

If you’ve received a cheque for your car tax refund but it’s in the wrong name, you’ll need to contact the DVLA’s refund section at Refund Section, DVLA, Swansea, SA99 1AL.

What won’t the DVLA refund?

You’ll only get a refund on the car tax. You won’t get a refund on extra charges incurred, for example if you’re paying in instalments or have used a credit card.

How do I tax and insure my new car?

If you’ve sold your old car and have a new one, you’ll need to make sure it’s taxed –find out how to do this in our How to tax a car guide.

You’ll also need to insure your new car, which you can do right here by comparing deals from some of the UK’s leading insurers (don’t forget to cancel your existing policy if you have one).